EPF (Employees’ Provident Fund), also referred to as PF (Provident Fund), is a mandatory savings cum retirement scheme for employees of an eligible organisation. This fund is intended to be a corpus on which the employees can fall back on in their retired life. As per the EPF norm, the employees must contribute 12% of their basic pay every month. A matching amount is contributed by the employer as well. The amount deposited in EPF accounts earns interest on an annual basis. Employees can withdraw the entire sum accumulated in their EPF once they retire. However, premature withdrawals can be made on meeting certain conditions which are explained in this article.

Here, it would be relevant to mention that Employees’ Provident Fund Organisation has allocated UAN, i.e. the Universal Account Number compulsory for all the employees covered under the PF Act. The UAN would be linked to the employee’s EPF account. The UAN remains portable throughout the lifetime of an employee, and there is no need to apply for EPF transfer at the time of changing jobs.

One may choose to withdraw EPF entirely or partially. EPF can be completely withdrawn under any of the following circumstances:

a. When an individual retires

b. When an individual remains unemployed for more than two months. To make a withdrawal on this circumstance, the individuals must get an attestation of the same from a gazetted office.

The complete withdrawal of EPF while switching employers without remaining unemployed for two months or more (i.e. during the interim period between changing jobs), is against the PF rules and regulations and therefore is not allowed. Partial withdrawal of EPF can be made under certain circumstances and subject to certain prescribed conditions which have been discussed in brief below:

Partial withdrawal of EPF can be done under certain circumstances and subject to certain prescribed conditions which have been discussed in brief below:

| S No. | Particulars of reasons for withdrawal | Limit for withdrawal | No. of years of service required | Other conditions |

| 1 | Medical purposes | Six times the monthly basic salary or the total employee’s share plus interest, whichever is lower | No criteria | Medical treatment of self, spouse, children, or parents |

| 2 | Marriage | MarriageUp to 50% of employee’s share of contribution to EPF | 7 years | For the marriage of self, son/daughter, and brother/sister |

| 3 | Education | Up to 50% of employee’s share of contribution to EPF | 7 years | For the marriage of self, son/daughter, and brother/sister |

| 4 | Purchase of land or purchase/construction of a house | For land – Up to 24 times of monthly basic salary plus dearness allowance For house – Up to 36 times of monthly basic salary plus dearness allowance, Above limits are restricted to the total cost |

5 years | i. The asset, i.e. land or the house should be in the name of the employee or jointly with the spouse. ii. It can be withdrawn just once for this purpose during the entire service. iii. The construction should begin within 6 months and must be completed within 12 months from the last withdrawn instalment. |

| 5 | Home loan repayment | Least of below: 1. Up to 36 times of monthly basic salary plus dearness allowance 2. Total corpus consisting of employer and employee’s contribution with interest. 3. Total outstanding principal and interest on |

10 years | i. The property should be registered in the name of the employee or spouse or jointly with the spouse. ii. Withdrawal permitted subject to furnishing of requisite documents as stated by the EPFO relating to the housing loan availed. iii. The accumulation in the member’s PF account (or together with the spouse), including the interest, has to be more than Rs 20,000. |

| 6 | House renovation | Least of the below: Up to 12 times the monthly wages and dearness allowance, or Employees contribution with interest, or Total cost |

5 years | i. The property should be registered in the name of the employee or spouse or jointly held with the spouse. ii. The facility can be availed twice: a. After 5 years of the completion of the house b. After the 10 years of the completion of the house |

| 7 | Partial withdrawal before retirement | Up to 90% of accumulated balance with interest | Once the employee reaches 54 years and withdrawal should be within one year of retirement/superannuation | ----- |

For this, one can download the new composite claim (Aadhaar)/composite claim form (Non-Aadhaar) from here :

The new composite claim form (Aadhaar) can be filled and submitted to the respective jurisdictional EPFO office without the attestation of the employer whereas, the new composite claim form (Non-Aadhaar) shall be filled and submitted with the attestation of the employer to the respective jurisdictional EPFO office. One may also note that in case of partial withdrawal of EPF amount by an employee for various circumstances as discussed in the above table, very recently, the requirement to furnish various certificates has been alleviated and the option of self-certification has been introduced for the EPF subscribers. (For details, you can refer order dated 20.02.2017 of the EPFO by clicking here)

Interestingly, the EPFO has very recently come up with the online facility of withdrawal, which has made the entire process more comfortable and less time-consuming.

To apply for the withdrawal of EPF online through the EPF portal, make sure that the following conditions are met:

1. The UAN (Universal Account Number) is activated, and the mobile number used for activating the UAN is in working condition.

2. The UAN is linked with your KYC, i.e. Aadhaar, PAN and the bank details along with the IFSC code.

If the above conditions are met, then the requirement of attestation of the previous employer to carry out the process of withdrawal can be done away with.

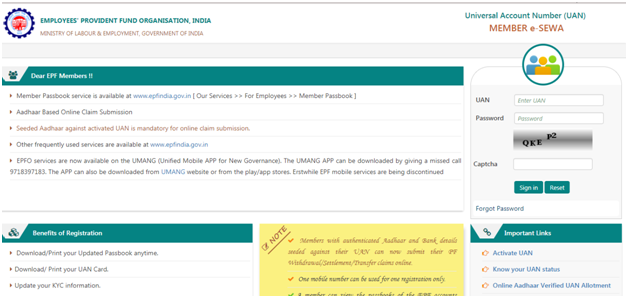

Step 1: Go to the UAN portal by clicking here .

Step 2: Log in with your UAN and password and enter the captcha.

Step 3: Then, click on the tab ‘Manage’ and select KYC to check whether your KYC details such as Aadhaar, PAN and the bank details are correct and verified or not.

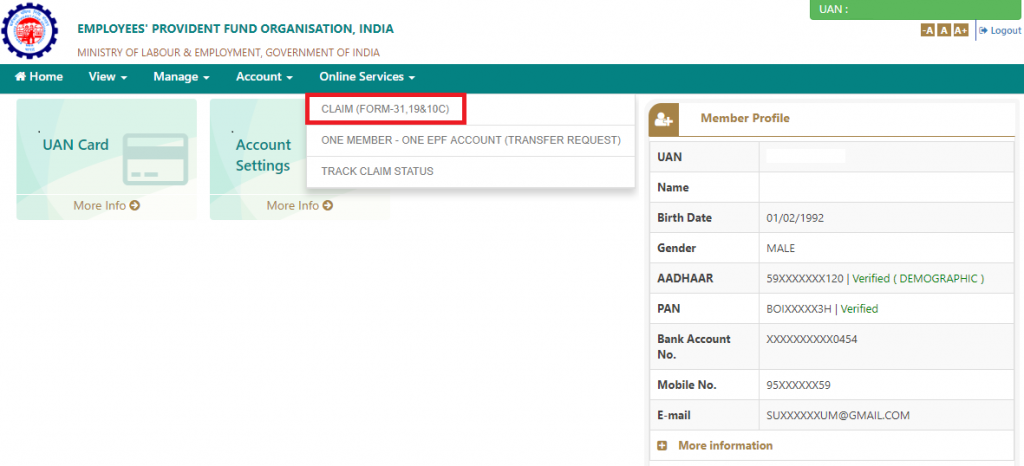

Step 4: After the KYC details are verified, go to the tab ‘Online Services’ and select the option ‘Claim (Form-31, 19 & 10C)’ from the drop-down menu.

Step 5: The ‘Claim’ screen will display the member details, KYC details and other service details. Enter the last four digits of your bank account and click on ‘Verify’.

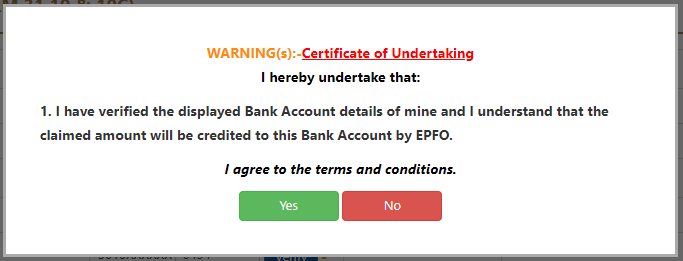

Step 6: Click on ‘Yes’ to sign the certificate of the undertaking and then proceed.

Step 7: Now, click on ‘Proceed for Online claim’.

Step 8: In the claim form, select the claim you require, i.e. full EPF settlement, EPF part withdrawal (loan/advance) or pension withdrawal, under the tab ‘I Want To Apply For’. If the member is not eligible for any of the services like PF withdrawal or pension withdrawal, due to the service criteria, then that option will not be shown in the drop-down menu.

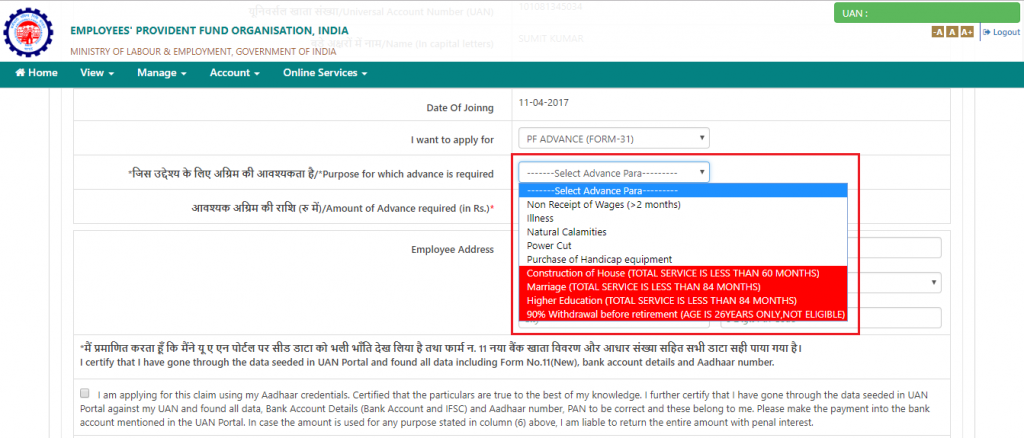

Step 9: Then, select ‘PF Advance (Form 31)’ to withdraw your fund. Further, provide the purpose of such advance, the amount required and the employee’s address.

Step 10: Click on the certificate and submit your application. You may be asked to submit scanned documents for the purpose you have filled the form. The employer will have to approve the withdrawal request and then only you will receive money in your bank account. It usually takes 15-20 days to get the money credited to the bank account.

You can follow the procedure given below to apply for a home loan based on your EPF account balance:

Step 1: Apply for a home loan through the housing society to the EPF Commissioner in the format specified in Annexure 1.

Step 2: The Commissioner will issue a certificate which states the monthly contribution to your EPF account over the last three months. Alternatively, you can take a printed copy of your EPF passbook to show the last three months contribution.

Step 3: You can opt for a lump sum payout or instalments.

Step 4: EPFO makes the payment to the housing society directly.

Q. Are EPF contributions eligible for tax deductions? A. Yes, EPF contributions are tax-deductible under Section 80C of the Income Tax Act, 1961.

Q. Can I increase my EPF contributions? A. Yes, you can increase your EPF contributions and contribute up to 100% of your basic pay. This is called VPF.

Q. Will employer also contribute higher when I do? A. No, the employer’s contribution will still remain the bare minimum regardless of you opting for VPF.

Q. Do I need employer’s permission to withdraw EPF from EPF? A. The new amendments have meant that the employer’s permission is not needed to make the EPF withdrawals.

Q. Can I make premature withdrawals? A. Yes, on meeting certain conditions, you are allowed to make premature withdrawals, and you need to produce documentary evidence for the same.